Surprising fact: Colombia has 120 Free Trade Zones and allows 100% foreign ownership, a combination that can cut landed costs and speed first sales.

We view Colombia as a nearshore gateway across latin america. With the united states free trade pact and dual-ocean access, this country offers tangible trade advantages.

Companies can form an S.A.S., S.A., Ltda., or a branch and often register within 4–6 weeks when documents and Spanish translations are ready.

Tax realities shape our cash flow: headline corporate tax is 35% (20% inside Free Trade Zones), VAT is 19%, and local ICA/RETEICA plus withholding rules affect payments.

From day one we map DIAN UBO rules, IFRS reporting, and notary or apostille steps so compliance does not slow growth.

Key Takeaways

- Colombia allows 100% foreign ownership and fast incorporation when documentation is complete.

- Free Trade Zones (120 nationwide) offer lower tax rates and special e-commerce treatment.

- Plan around 35% corporate tax, 19% VAT, and municipal ICA/RETEICA impacts.

- Early DIAN registration, UBO disclosure, and IFRS statements are mandatory compliance steps.

- Success depends on local teams, Spanish capability, and clear timelines to first invoice.

Why Colombia Now: A Strategic Gateway to Latin America

With stabilizing macro fundamentals and fast-improving logistics, we see Colombia as a practical hub for regional expansion. The country exceeds 50 million people and has a median age near 31, giving us a young, bilingual workforce that supports services and tech roles.

Growth signals U.S. executives should watch in 2025 and beyond

GDP was roughly US$363.5 billion in 2023 and inflation sat near 5.09% YoY in early 2025. We view that stability, plus rising household connectivity, as signs of selective growth compared with some latin american economies.

Demographics, urban hubs, and a rising middle class shaping demand

Major metros—Bogotá, Medellín, Cali, and Barranquilla—anchor finance, innovation, manufacturing, and port distribution. We leverage dual-ocean access and 4G road and port upgrades to shorten supply lines and improve access across the region.

- Talent depth: university pipelines and bilingual staff fuel BPO and software roles.

- Demand cues: e-commerce and middle-class growth shape product and channel plans.

- Risk monitor: we track central bank policy, exchange rates, and trade cycles to time our moves.

Opportunity Landscape: Priority Sectors and Where We See Value

Colombia offers clear pockets of opportunity across services, agriculture, and tech hubs that reward early pilots. We prioritize sectors where a bilingual workforce and Free Trade Zone incentives lower costs and shorten time to measurable outcomes.

Services surge: BPO, e‑commerce, healthcare, and software.

We target services with the strongest tailwinds—BPO and e‑commerce enablement sit alongside healthcare solutions and software. Bogotá supplies a deep pool of English‑proficient graduates that lets companies scale delivery quickly.

Modernizing staples: agriculture, mining, renewable energy

Legacy sectors need digital transformation and precision tools. We deploy agtech for irrigation and post‑harvest logistics, mining tech for safety and monitoring, and renewables tied to Colombia’s Just Energy Transition.

Innovation corridors: Bogotá, Medellín, Cali, Caribbean region

We align footprints to talent clusters—Bogotá for shared services, Medellín for R&D, Cali for manufacturing integration, and the Caribbean coast for port distribution. Pilots with anchor clients prove value through clear KPIs.

| Priority Sector | Lead Cities | Primary Advantage | Quick KPI |

|---|---|---|---|

| Services (BPO, software) | Bogotá, Medellín | Cost + bilingual workforce | Time-to-productivity (weeks) |

| Healthcare & e‑commerce | Bogotá, Cali | FTZ import savings | Hospital throughput / conversion |

| Agritech & Renewables | Cali, Caribbean | Modernization + sustainability | Energy savings / yield uplift |

- We position digital transformation offerings to accelerate adoption across finance, retail, and logistics.

- We leverage FTZ mechanics and trade enablers to optimize inventory and omnichannel supply chains.

- We pilot with local partners so companies looking to scale can show tangible value fast.

Choosing the Right Entry Path: Entities, Ownership, and Timing

Choosing the right legal vehicle shapes cost, liability, and how fast we can invoice local clients. We prioritize options that let us start quickly while protecting assets and meeting compliance needs.

Full foreign ownership and common vehicles

Foreign investors may hold 100% of a company. Common forms include S.A.S. (flexible, no minimum capital), S.A. (board required, ≥5 shareholders), Ltda. (2–25 partners), and branches (extensions of a foreign firm).

Governance, liability, and audit triggers

We map governance early: S.A. and branches often trigger statutory auditors. All entities must file IFRS statements as business operations scale.

Registration flow and typical timelines

The sequence we follow: draft bylaws, notarize and apostille documents, register with the Chamber of Commerce, obtain NIT from DIAN, open local bank accounts, and enroll in social security.

- We streamline KYC by pre-aligning the legal representative’s cedula and in-person validation.

- Plan for electronic invoicing, municipal ICA setup, and practical tax calendars to avoid delays.

- With correct paperwork, incorporation typically takes 4–6 weeks.

| Entity | Best when | Key constraint |

|---|---|---|

| S.A.S. | Speed and flexibility | No board requirement |

| S.A. | Larger governance | ≥5 shareholders |

| Branch | Consolidated reporting | Auditor triggers |

Regulatory and Tax Essentials for Market Entry

Tax and regulatory clarity shapes how quickly we translate a plan into revenue in Colombia.

We price and model around a headline corporate tax rate of 35%, with a reduced 20% rate inside free trade zones. VAT sits at 19% and must be mapped to goods and services to protect input credits.

Municipal levies matter: ICA/RETEICA range from 4.14 to 11.04 per 1,000 depending on activity and city. Withholding taxes run from 1%–11% by payment type. A 0.4% financial transactions tax applies to withdrawals.

Consumption taxes apply in tiers (4%, 8%, 16%) and can affect employee perks, telecom, and fleet costs. We track DIAN updates closely because frequent reforms change the fiscal environment.

Compliance, UBO, and reporting

DIAN Resolution 164 (late 2024) expanded UBO disclosure. We maintain a UBO process, file IFRS financial statements, and budget for external audits where branches or S.A. structures trigger them.

- Model cash flow with withholding bands and the 0.4% transaction tax.

- Coordinate FTZ use with customs rules to lock benefits and avoid penalties.

- Keep a regulatory radar for government policies so our business colombia footprint stays resilient for foreign investment.

People, Visas, and Payroll: Building a Compliant Workforce

Building a compliant team in Colombia starts with practical visa choices and fast cedula processing.

We select the right visa path—the M visa for investor tracks and the R visa for longer-term residence. An M visa can be obtained via investment in a business or real estate. After five years on an M visa, applicants may apply for an R visa.

M and R investor visas, cedula ID, and banking activation

Visa processing generally takes 2–4 weeks when documents are complete and in Spanish.

We schedule cedula issuance immediately after visa approval so the legal representative can open bank accounts and activate payroll without delay.

Labor costs, social security, and evolving working-hour rules

Employers must register workers for health, pension, and labor risks. We model total labor costs beyond salary to include severance, parafiscales, and employer contributions.

A 9.53% minimum wage rise took effect in December 2024. Laws 2101/21 and 2121/21 change work hours and remote-work rules; we update contracts and internal policies to stay compliant.

- We align payroll calendars and DIAN tax controls to reduce errors and preserve cash flow.

- We build local talent brands so companies recruit faster and measure success by retention and speed-to-productivity.

| Topic | Requirement | Typical time |

|---|---|---|

| Investor Visa (M → R) | Investment proof; Spanish docs | 2–4 weeks; 5 years to R |

| Cedula & Banking | ID registration; bank onboarding | Immediate after visa |

| Payroll & Social Security | Health, pension, labor risks | First payroll cycle |

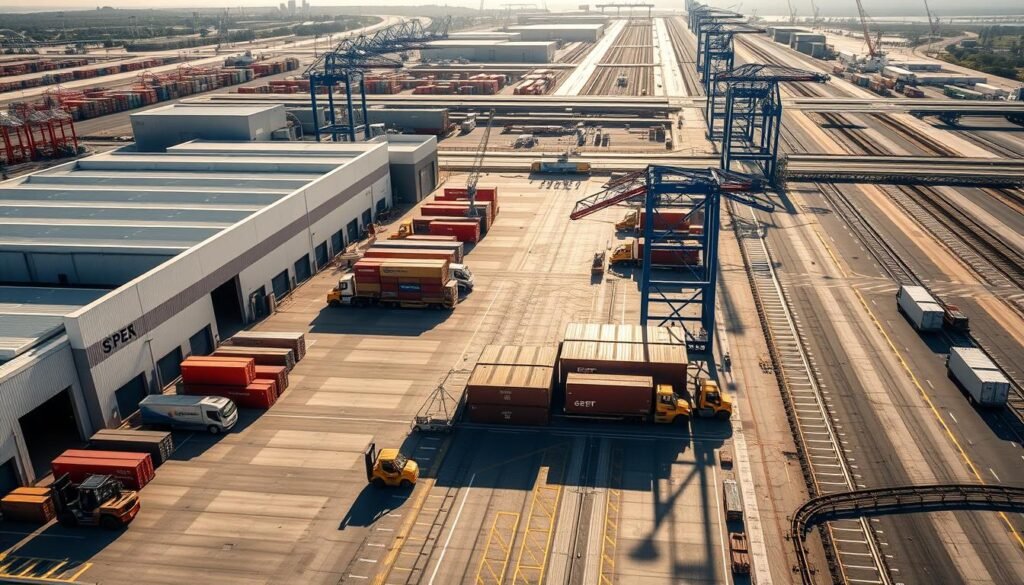

Free Trade Zones, Infrastructure, and Logistics Advantages

Leveraging 120 specialized trade zones gives our teams clear advantages in customs and cash conversion. The country hosts 42 permanent multi-company parks and 78 special single-company sites. Decree 278 shortened the setup timeline to about nine months and allows flexible use changes.

How 120 Free Trade Zones create tax and operational benefits

We evaluate free trade zones for lower CIT (20%), customs efficiencies, and bonded inventory models that speed cash conversion. Permanent parks suit shared services and common infrastructure.

Special single-company sites suit tailored operations for manufacturing or large logistics hubs. We quantify FTZ incentives against city costs to pick the best business colombia configuration.

Bogotá’s Zona Franca, e-commerce treatment, and remote work enablement

Bogotá’s Zona Franca is our preferred node for e-commerce. Sales from FTZs are not treated as imports, so local fulfillment flows faster and customs friction drops.

Decree 278 also lets up to 50% of the FTZ workforce operate remotely. We design hybrid operations to cut real estate spend while keeping service levels high.

Roads, ports, airports: leveraging 4G upgrades for regional operations

Colombia provides upgraded 4G highways and modernized ports (Cartagena, Barranquilla, Buenaventura) plus improved airports in Bogotá, Medellín, and Cali. This infrastructure shortens lead times and increases regional access.

We map spare-parts and after‑sales logistics to FTZ rules so warranty replacements, reverse logistics, and support stay compliant and fast.

| Use | Best fit | Operational advantage |

|---|---|---|

| Permanent multi-company | Shared services, distribution | Lower capex; shared logistics |

| Special single-company | Manufacturing, bespoke ops | Tailored controls; dedicated space |

| Bogotá Zona Franca | E‑commerce & fulfillment | Not treated as import; faster delivery |

- We plan compliance audits early to protect free trade benefits and maintain clear inventory KPIs.

- We align FTZ timelines with facility builds and client ramps using Decree 278’s faster approvals.

- We pick nodes that maximize access to the Andean and Caribbean region, ensuring predictable logistics and resilient operations.

Market Entry Strategy for U.S. Businesses in Colombia

We sequence launches around four practical pillars so teams reach first revenue fast. Our approach ties local validation to scalable operations. That keeps risk manageable and timelines predictable.

Sequencing our approach: research, localization, compliance, and scale

We begin with targeted research to test sector fit and cluster strength. Small pilots validate product, pricing, and channel assumptions.

Localization follows: Spanish-first messaging, local pricing, and partnership mapping. This reduces friction and speeds adoption.

Compliance runs in parallel. We lock entity choice, tax treatment, social rules, and a government calendar with DIAN and labor authorities.

Scale uses shared services, FTZ nodes, and regional hubs to improve margins and logistics access.

Managing risk: bureaucracy, security, ESG, and currency considerations

We maintain a risk register that tracks timelines, regional security, and policy shifts. That lets us react before issues escalate.

We hedge currency, keep multi-bank setups, and review transfer pricing to protect working capital.

We also set an ESG baseline and adapt disclosures to local expectations so compliance becomes a reputation asset.

Trade agreements and the U.S.-Colombia FTA as levers for speed and savings

We leverage the U.S.-Colombia FTA and other trade agreements to cut duties and speed customs clearance. Using free trade benefits lowers landed costs and shortens time-to-revenue.

Channel plans align to dual-ocean access, upgraded highways, and ports so logistics meet service targets across cities.

| Focus | Action | Benefit |

|---|---|---|

| Research & Pilots | Sector tests, anchor clients | Faster validation; lower spend |

| Compliance | Entity, DIAN, labor calendar | Predictable filings; fewer fines |

| Scale & FTZ | Shared services, FTZ use | Lower tax, better logistics |

| Risk & ESG | Register, hedges, disclosures | Operational resilience; reputation |

Your Next Steps in Colombia: From Plan to First Sale

We start with a tight 90–180 day roadmap that converts compliance into operational speed.

We set clear milestones so a new business can form an entity in 4–6 weeks, secure visas in 2–4 weeks, and align bank KYC once the cedula is issued.

Our plan preserves time and value: entity formation, tax and e‑invoicing, bank/KYC and payroll, then the first pilot and invoice. We keep steps repeatable so companies scaling operations can onboard staff and vendors with ease.

For companies looking to reduce duty burdens, we leverage the U.S.-Colombia FTA and FTZ options—recognizing FTZ approvals may take longer but offer a strong advantage in logistics and cost.

We measure success by setup time, first invoice date, SLA attainment, and cash conversion. With local advisors engaged, business colombia becomes a predictable path to scale in this country and market. A medida que optimizamos estos indicadores, nuestra estrategia se centra en maximizar los beneficios de crear una empresa SAS, lo que ofrece una flexibilidad operativa y fiscal que es esencial en este entorno dinámico. Además, la colaboración con nuestros asesores locales asegura que entendamos y aprovechemos las oportunidades del mercado colombiano, facilitando un crecimiento sostenible y escalable. Este enfoque nos permite adaptarnos rápidamente a las demandas del mercado y garantizar un proceso de expansión exitoso.